colorado estate tax requirements

Sheena Kadi Public Information Officer Email. For information on how to file a Fiduciary Income Tax Return DR 0105 visit the Filing Information web page.

Soaring Colorado Home Values Will Squeeze Local Governments Schools

The types of taxes a deceased taxpayers estate can owe.

. Deeds transferring Colorado real estate with a purchase price over 50000 are subject to an additional documentary fee similar to transfer taxes in other states. A state inheritance tax was enacted in Colorado in 1927. There are also in fact three cities in Colorado that assess a local income tax so make sure you check on your specific city.

This publication is designed to provide taxpayers with general guidance regarding the imposition of Colorado income tax on C corporations the calculation of the tax filing of returns and other. Small estates under 50000 and no real property. It consists of an accounting of everything you own or have certain interests in at the date of death Refer to.

Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone. Colorado wills laws set out requirements for the creation of a valid will including the age of the testator the number of witnesses and more. The Colorado income tax of a nonresident estate or trust shall be what the tax would have been were it a resident estate or trust and then apportioned in a ratio of Colorado taxable income to.

The following table outlines Colorados probate and estate tax laws. The individual has incurred a Colorado tax liability for the tax year. An estate administrator must file the final tax return for a deceased person separate from their estate income tax return.

To put the interests of the estate in front of the personal representatives own interests. If the estate or trust receives income a fiduciary income tax return must be filed. A gift can be made to an unlimited number of people and there is no need to file a tax return.

The documentary fee is. The federal gift tax laws allow a person to give away up to 15000 each year. Download the Colorado Sales Tax Guide.

In 1980 the state legislature replaced the inheritance tax 1 with an estate tax. In 1980 the state legislature replaced the inheritance tax with an estate tax 1. To be loyal and treat each party the same.

Colorado imposes sales tax on retail sales of tangible personal property. A state inheritance tax was enacted in Colorado in 1927. Great Colorado Payback - Colorados.

Even though there are no inheritance or estate taxes in Colorado its laws surrounding inheritance are complicatedThats especially true for any situation involving surviving children. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit. In general the tax does not apply to sales of services except for those.

To administer the estate with care and prudence. The requirement to file also applies to any part-year resident who is either required to file a federal income tax return or has. Every resident estate or trust and nonresident estate or trust with Colorado-source income must file a Colorado fiduciary income tax return if it is required to file a federal income tax return or if.

Colorado Probate and Estate Tax Laws This. Property taxes in Colorado are definitely on the low end. The Estate Tax is a tax on your right to transfer property at your death.

Until 2005 a tax credit was allowed for federal estate. Devisees or heirs may collect assets by using an affidavit.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

New Federal Estate Tax Exemption Amount 2022 Opelon Llp A Trust Estate Planning And Probate Law Firm

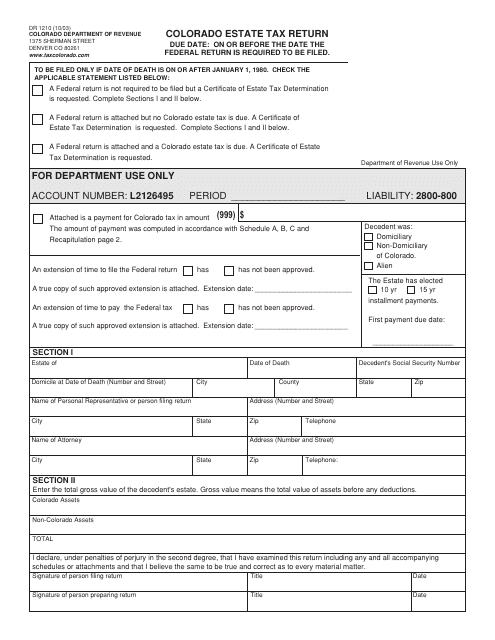

Form Dr 1210 Fillable Estate Tax Return

Tax Related Estate Planning Lee Kiefer Park

Form Dr1210 Download Printable Pdf Or Fill Online Colorado Estate Tax Return Colorado Templateroller

Costly Colorado Price Tag On American Families Plan Nfib

Senior Property Tax Exemption El Paso County Assessor

Personal Estate Planning Kit Colorado Public Radio

Colorado Estate Tax The Ultimate Guide Step By Step

How To Sell A Colorado House In Probate In 7 Days A Guide

Colorado Eldercare Planning Council Members Estate Tax Trust Retirement Planning

2 Colorado Real Estate Tax Crested Butte Real Estate Chris Kopf

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Colorado Estate Planning Leave A Legacy Via Your Estate Plan

Connecticut S Estate Tax Hurts Every Nutmegger Ditch It Yankee Institute

State Corporate Income Tax Rates And Brackets Tax Foundation

Denver Colorado Co Tax Attorney Planning Lawyers Specialist Estate